Tradesoft NY: imbalance + institutional strength at the open

Tradesoft NY (TSNY) is built for the S&P 500 futures market using the Micro E-mini (MES) on a 1-minute chart. It measures imbalance and institutional strength/volume around the US open to spot whether larger participants are stepping in to buy or sell.

TSNY takes one trade per day, and positions are closed no later than 2:25 PM ET (19:25 Madrid time). It is a guided execution framework (not an unattended bot): it keeps you aligned with a clear, repeatable process across the full trade.

How Tradesoft NY thinks (pro mode)

TSNY does not “predict” the market. It seeks confirmed intent. The edge comes from reading imbalance, strength, and volume during the US open to identify whether the move has real institutional participation or is just volatility without commitment.

-

US open: where size speaks

The system focuses on the moment flow enters. The open tends to show cleaner displacement and more decisive participation.

-

Imbalance: progress vs absorption

TSNY evaluates whether price progresses with continuation or whether absorption appears (high volume with little progress). That often reveals intent.

-

Institutional volume: confirm the dominant side

By combining strength/volume reads, TSNY detects whether there is real interest to buy or sell and filters questionable trades.

-

Guided execution: not a bot, a framework

The system enforces a decision path: context → signal → execution → management. You execute; TSNY keeps you aligned.

-

One trade per day + fixed close time

TSNY prioritizes quality: one selected trade managed with discipline. Positions are closed no later than 2:25 PM ET.

Realistic note: Trading involves risk. Fees, slippage, spreads, and news can impact results. TSNY is designed to reduce noise and overtrading through selection and structure, but no system can guarantee outcomes.

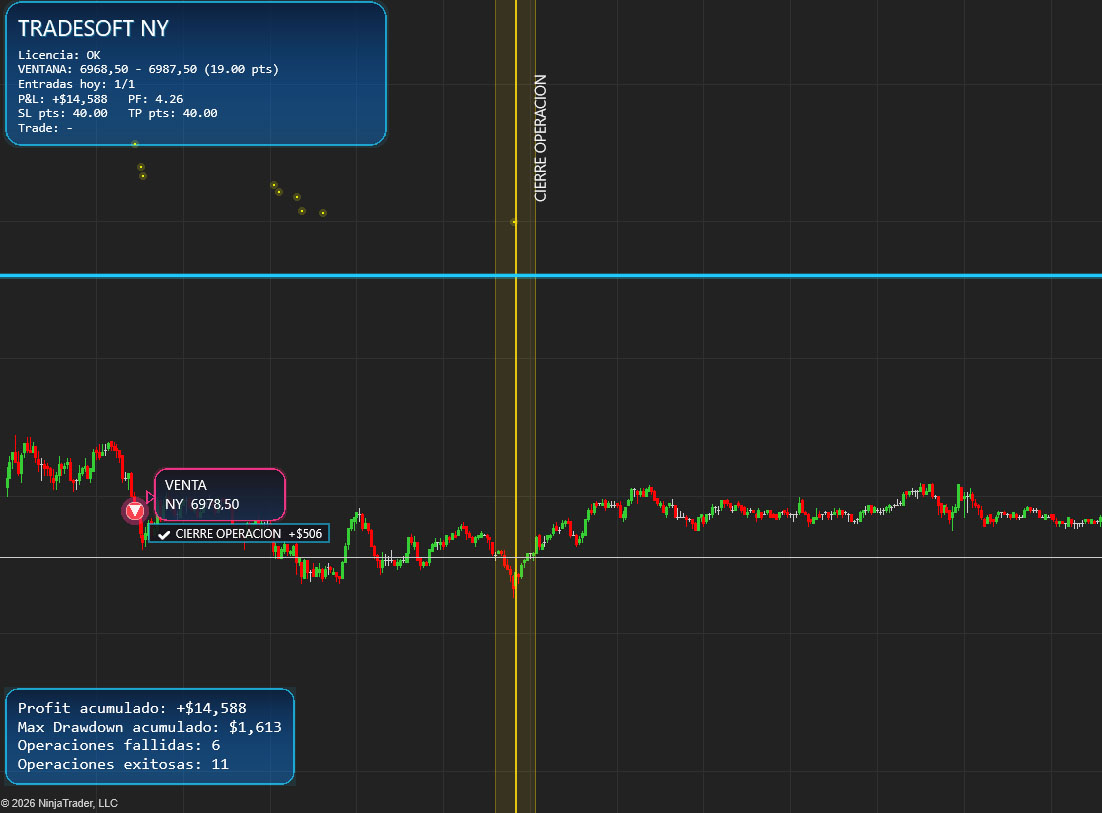

Real TSNY example (disciplined close)

Reference screenshot of the TSNY approach with a defined close. Click to zoom.

When TSNY performs best

TSNY performs best when the open sets direction with clear imbalance: strong continuation, obvious absorption, breakouts that fail and reclaim, or reversals backed by real participation. In those conditions, it helps you trade with criteria, avoid overtrading, and respect the fixed close.