SDA: real order flow, live entries

SDA (Adaptive Dynamic Sentiment) is built for the US futures intraday trader who wants an institutional read. It does not chase static patterns. It waits for the exact moment the market reveals aggression, absorption, and failed continuation after a displacement (inefficiency or liquidity void).

Instead of entering because of candle shape, SDA trades the auction dynamics: it highlights where trapped traders are likely to exist (LVN, extremes, failed breakouts), where rotation back into value is probable (POC and value area), and it requires flow confirmation before marking an opportunity with a clean invalidation point. This fits perfectly on CME products like ES, NQ, YM, RTY and other US session markets.

What SDA does (in technical terms)

SDA looks for setups where price displaces (fast impulse) and leaves behind a region with low two-way trade, the typical inefficiency where the market did not auction cleanly. When price returns into that region, SDA does not assume anything. It demands order flow evidence to validate that strong hands are defending or flipping the move.

-

Context (balance vs imbalance)

SDA classifies the session: are we rotating inside value (balance) or expanding (imbalance)? That decides whether we prioritize rotations into POC/value area or reversals after a stop run during the US session.

-

Value and trap zones (LVN, POC, value area)

Entries are prioritized around LVNs (thin trade), POC, and value area edges. These are the places where stop runs, trapped traders, and rotations back to value are common, especially on US index futures.

-

Confirmation via aggression and absorption

SDA looks for real pressure: delta shifting, absorption (aggressive execution with no progress), and imbalances that signal defense or a turn at the level. This is what filters for quality rather than quantity.

-

Invalidation: where the idea dies

Every SDA signal comes with a logical invalidation point. If price accepts back against the idea (or re-expands hard), the read is no longer valid. This prevents holding a losing bias.

-

Institutional targets (rotation to value)

Exits are based on logical destinations: rotation toward POC, continuation within the value area, or closing the inefficiency. This matches intraday trades that can last one to four hours when the context supports it.

Realistic note: SDA is designed to prioritize high-probability setups only when context, level, and flow align. In favorable conditions and with discipline, it can show very high hit rates on selected setups, but it is not a promise. Markets change, slippage exists, and US data releases can shift volatility fast. That is why the foundation of SDA is invalidation and risk control.

Example of an SDA entry

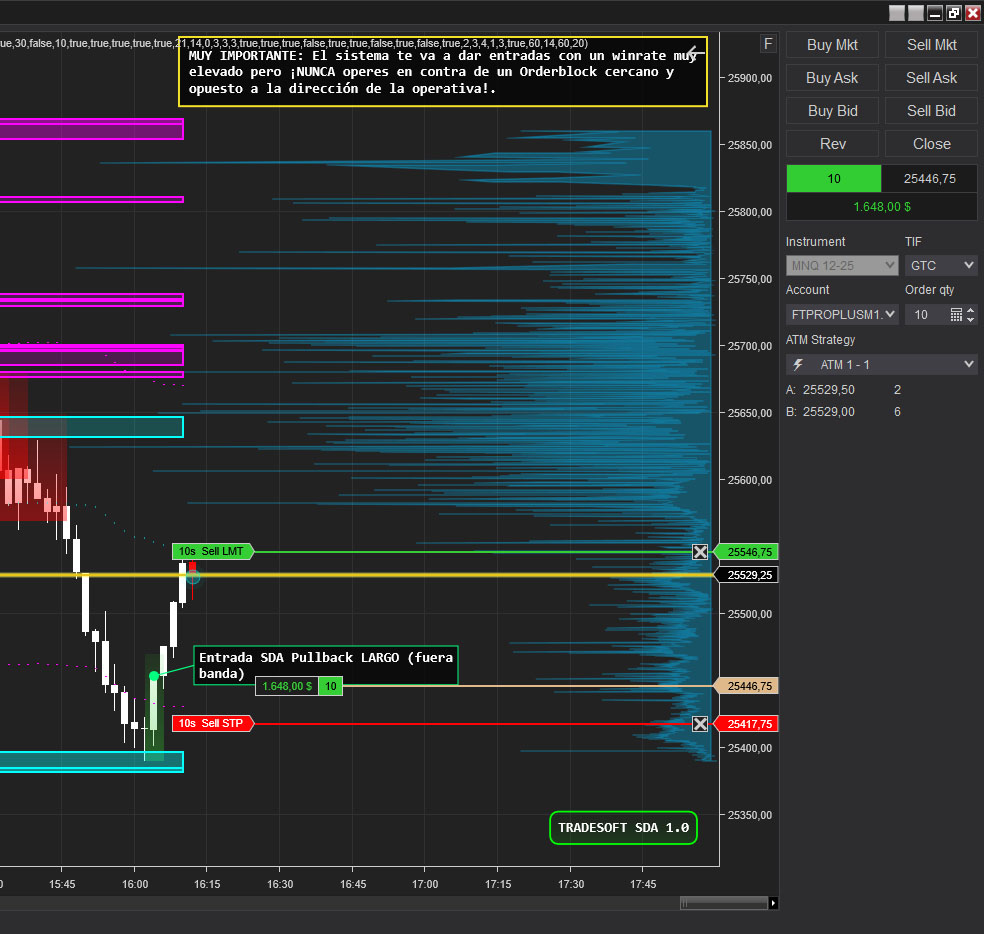

This is a real SDA setup screenshot: you can see the worked zone, the return into the area of interest, and the invalidation point. Click to open and zoom.

Why SDA is powerful for US intraday

If you trade intraday but can hold a position for one to four hours, SDA gives you an edge. Instead of chasing price, you wait for the market to return to a zone where a reaction makes sense (value or inefficiency) and then confirm with flow.

That reduces noise, improves entry location, and lets you aim for more institutional-style paths (rotation back into value) with measurable risk without relying on a single candle.