TS Scalp: value + inefficiency, at speed

TS Scalp is the surgical version of the system. It keeps the same read of value (POC / value area), inefficiencies (LVN / thin trade), and order flow, but it is built to capture fast, repeatable moves: micro-rotations, clean reclaims, short reversals, and snapbacks after a displacement.

If SDA is designed to let intraday trades breathe, TS Scalp prioritizes timing and precision: it enters where the market fails to accept price (absorption or failed continuation) and it exits where the market typically pays quickly: rotation back to value, a POC test, or an inefficiency close. This is a natural fit for US session activity on markets like ES, NQ, YM, RTY.

How TS Scalp thinks (pro mode)

TS Scalp does not try to predict. It looks for reactions at institutional locations. The edge is the combination of value or inefficiency + flow trigger + instant invalidation. Less story, more execution.

-

Zone selection: where the market pays fast

TS Scalp prioritizes value edges (VAH / VAL), POC tests, and LVNs after displacement. Clean zones, minimal noise, high probability of response.

-

Displacement to return: the real trigger

First comes impulse (aggression), then a return into the zone. On the return, the module looks for failed continuation: price tries to continue and cannot. That is where the scalp is born.

-

Micro-flow: absorption, delta, and clean reclaims

Fast confirmation: absorption at the level (aggressive execution without progress), delta flipping, or a clean reclaim through the key reference. This avoids blind scalps.

-

Surgical invalidation

If the market accepts the level against the idea (not just tags it), the setup is done. TS Scalp is built around small, logical stops. If you are wrong, you are out quickly.

-

Trade management: scale out and take the money

Tight, measurable targets: partials into the first push, and final exits on rotation back to value, a POC test, or an inefficiency close. Scalping is about getting paid, not hoping.

Realistic note: TS Scalp is built to capture short moves with high precision, but scalping requires discipline. Fees, slippage, news, and spreads can affect results. The edge lives in zone selection and invalidation, not in forcing trades.

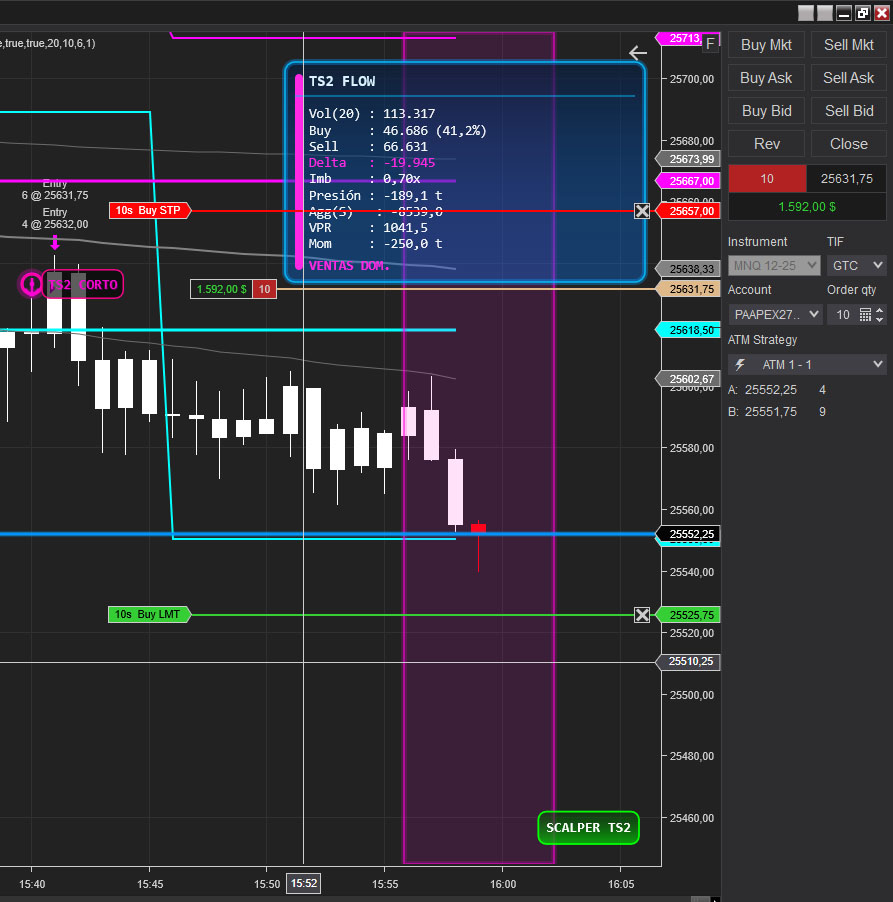

Real TS Scalp trade example

Screenshot of a typical scalp: the zone, the confirmation, and the fast execution. Click to open and zoom.

When TS Scalp shines

TS Scalp is ideal when the market is active and leaves clean displacements: the US cash open, failed breakouts, stop runs and reclaims, or quick rotations on value edges. In those conditions, the module helps you enter with timing, exit with a plan, and avoid chasing candles.