Tradesoft: Diversification Plan

We guide you step by step (no guesswork, no frustration)

We’ll guide you at every stage and show you how to approach your diversification plan and consistency, so you can stick to a profitability strategy built by combining modules (without losing your mind or your focus).

We’ll work with you side by side using our methodology and framework so you can finally reach consistency and profitability—and never again feel the frustration of losing accounts.

Tradesoft is a trading methodology that combines complementary systems and modules so you can trade with a plan, stability, and full control over your execution. Instead of betting everything on a single approach, Tradesoft promotes true risk diversification: different modules, different markets, different account types, and a defined use of leverage.

On top of that, we mentor you to implement the plan in a practical way: setup, rules, drawdown management, and using AI Copilot to reduce anxiety and keep decisions disciplined. The result: fewer doubts, less “darkness” in front of the chart, and a clear path for both new and experienced traders.

The 5 pillars of the Tradesoft plan (diversification + consistency)

1. Complementary modules. Each system covers a different “type of day” and trading speed (SDA, TS, NY).

2. Defined risk and leverage. Clear rules by account type (prop firm / personal capital) and size.

3. A repeatable process. Checklists + rules so you execute the same way on strong days and tough days.

4. AI Copilot + guidance. Support to trade with calm, consistency, and emotions under control.

5. A repeatable yearly plan. Allocation across accounts/firms/sizes to build stability with recurring gains.

This creates a trading portfolio: multiple return drivers, less dependence on a single pattern, and guided execution so you stop improvising.

The “Tradesoft portfolio”: a new level of focus

Tradesoft structures a plan so you don’t depend on just one way of trading. It defines which module to use, in which market, in which account type, and with what leverage, with one clear objective: recurring profits with a smoother curve and decisions under control.

In practice, diversification works like this: each module has a role and a context where it shines. When you combine them with per-account risk rules, you get a more robust plan than chasing random signals. Tradesoft helps you execute with discipline: trade what you’re supposed to, when you’re supposed to, and with the right size.

Tradesoft ecosystem modules (to diversify)

These modules are used as pieces of one global plan. They don’t compete—they complement each other. You get a clear “map” of what to use depending on account type, market, and context.

Module 01 · SDA (Adaptive Dynamic Sentiment)

Built for intraday trading with an “institutional” read: it doesn’t chase static patterns—it looks for moments when the market reveals aggression, absorption, and continuation failure after displacement and inefficiencies.

View SDA moduleModule 02 · TS (Institutional scalping)

A “surgical” version focused on fast, repeatable moves: micro-rotations, reclaims, short reversals, and snapbacks. It combines value (POC/VA), inefficiencies (LVN/voids), and flow with immediate invalidation.

View TS moduleModule 03 · Tradesoft NY (TSNY)

An open-focused approach: reading imbalance and institutional strength/volume to identify buy/sell intent. Operating plan: one trade per day and a disciplined close with clear rules.

Request TSNY infoModule 04 · AI Copilot (calm decision support)

A guidance layer that evaluates context, levels, bias, and risk to steer decisions: hold, exit, or wait. It reduces anxiety and helps maintain calm and consistency all year long.

Request AI Copilot infoKey · Mentoring and a repeatable yearly plan

It’s not about “having tools”—it’s about using them inside a real plan. Tradesoft mentors how to use each module, defines which piece goes into each account/firm, what leverage to use, and how to build year-round consistency with clarity and confidence.

I want the full planThe goal isn’t to “trade more,” but to trade better: diversify risk and standardize execution, with clear rules on when to use each module, in which market, and with what leverage.

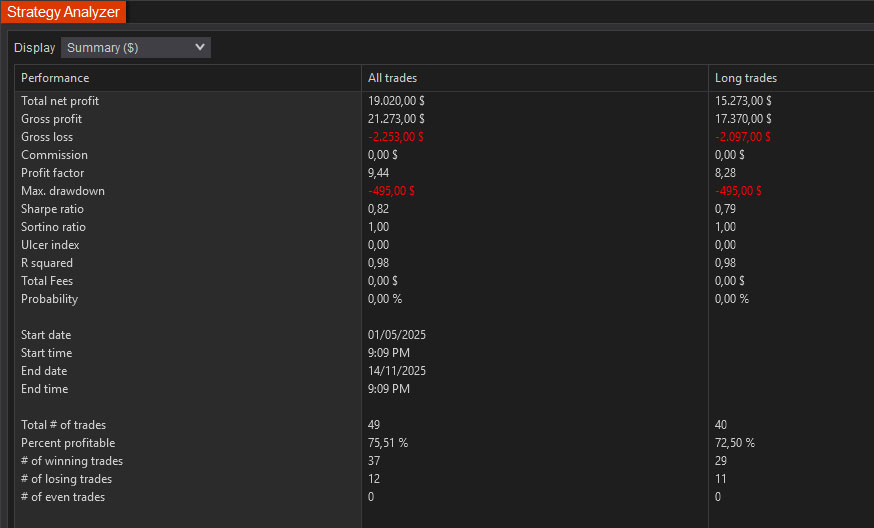

Backtest example (historical reference)

A backtest example as a historical reference for repeatability. In a consistency plan, it helps you understand how one piece of the portfolio behaves across different periods, and it helps you calibrate risk and expectations with clarity.

Tradesoft levels up your trading because it gives you the right tools and a complete plan. Diversification isn’t complication—it’s how you stop relying on “one good day” and start building year-round consistency with rules, modules, and controlled risk.

Tradesoft Calculator (by module and account type)

A calculator to estimate a conservative scenario per module and account, and confirm your per-trade risk fits within drawdown.

In the Tradesoft plan, diversification becomes something very practical: different modules with usage rules and defined leverage based on account size. AI Copilot reinforces the process so your decisions stay clean even when pressure rises.

Tradesoft diversification plan (practical example)

Example of how a yearly plan is structured: assign a module to an account type and define market, frequency, and leverage. This reduces dependence on a single setup and improves consistency.

| Account type | Main module | Market / pace | Typical use | Leverage (idea) | Goal |

|---|---|---|---|---|---|

| Small prop firm (e.g., 25K) | TSNY (open) | S&P 500 (MES) · 1m | 1 trade/day · disciplined close | Micro / conservative size | Smoother curve, less noise |

| Mid-size prop firm (e.g., 50K) | TS (scalping) | MNQ or ES · intraday | Micro-rotations, reclaims, inefficiencies | Controlled by DD | Frequent returns with bounded risk |

| Large prop firm (e.g., 150K) | SDA (intraday) | MNQ · institutional read | More “room” and context-based trades | More margin, same control | Consistency + context capture |

| All accounts | AI Copilot | Context + decisions | Guidance: hold / exit / wait | N/A | Calm, emotional control, discipline |

This plan can be replicated across multiple funding firms (extra diversification) and across different account sizes. Tradesoft helps you define it and execute it without second-guessing.

How Tradesoft “locks in” consistency

The key isn’t just entries—it’s staying in control over time. Tradesoft defines rules so your execution stays stable even when the market doesn’t cooperate.

| Control element | How the Tradesoft plan applies it |

|---|---|

| Per-trade risk (per account) | Risk is set as a fraction of the allowed drawdown (e.g., 5–15% depending on account and module). That keeps sizing “inside the plan” and prevents one bad day from wrecking the year. |

| Module-based diversification | Modules are assigned different roles (open, intraday, scalping) so you’re less dependent on a single market condition. |

| Defined leverage | Each account type has a target leverage. It doesn’t increase on impulse—it’s adjusted by rules (DD, volatility, setup quality). |

| AI Copilot + guidance | AI plus support reduces emotional mistakes: it helps you stay calm, cut when it’s time, and avoid trading during high uncertainty (macro/news/noise). |